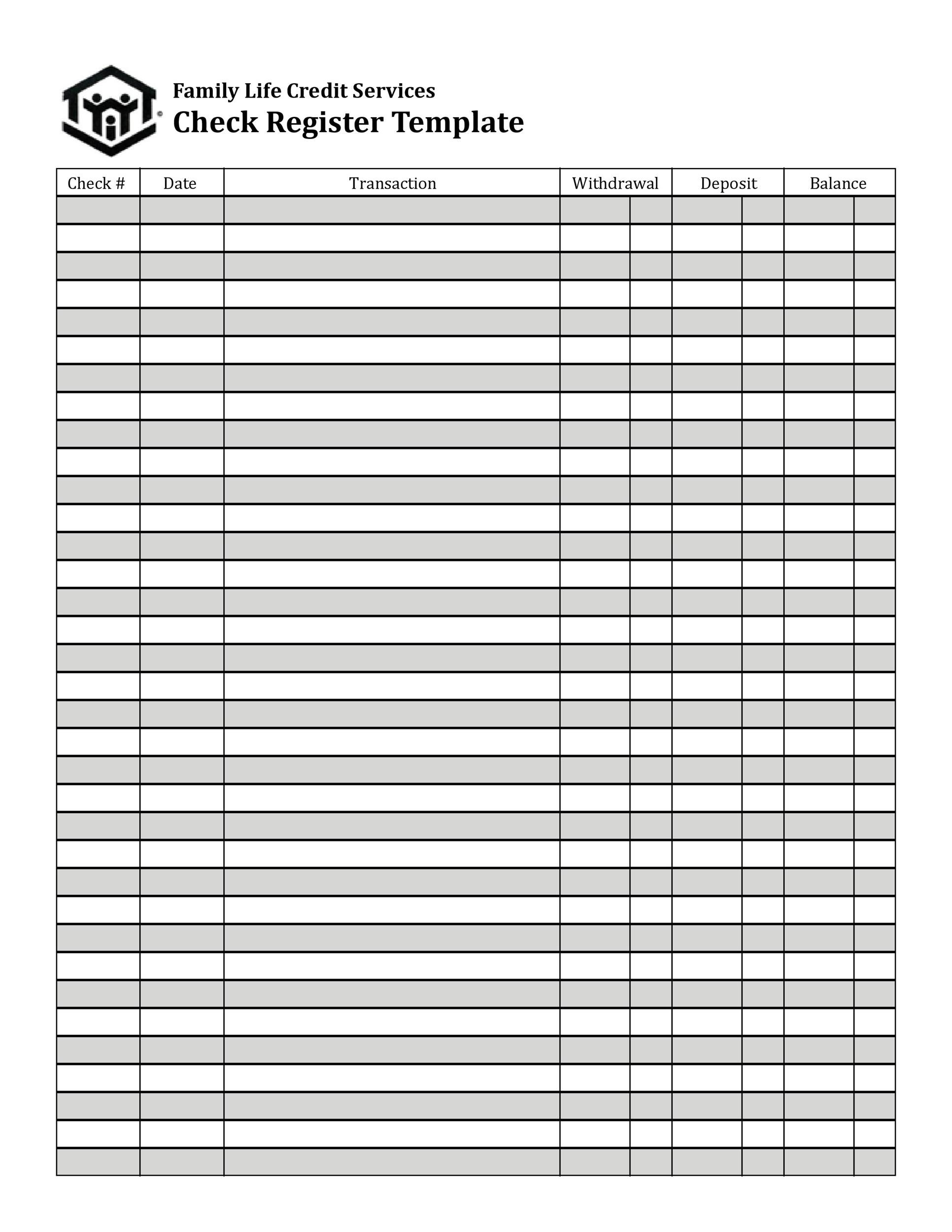

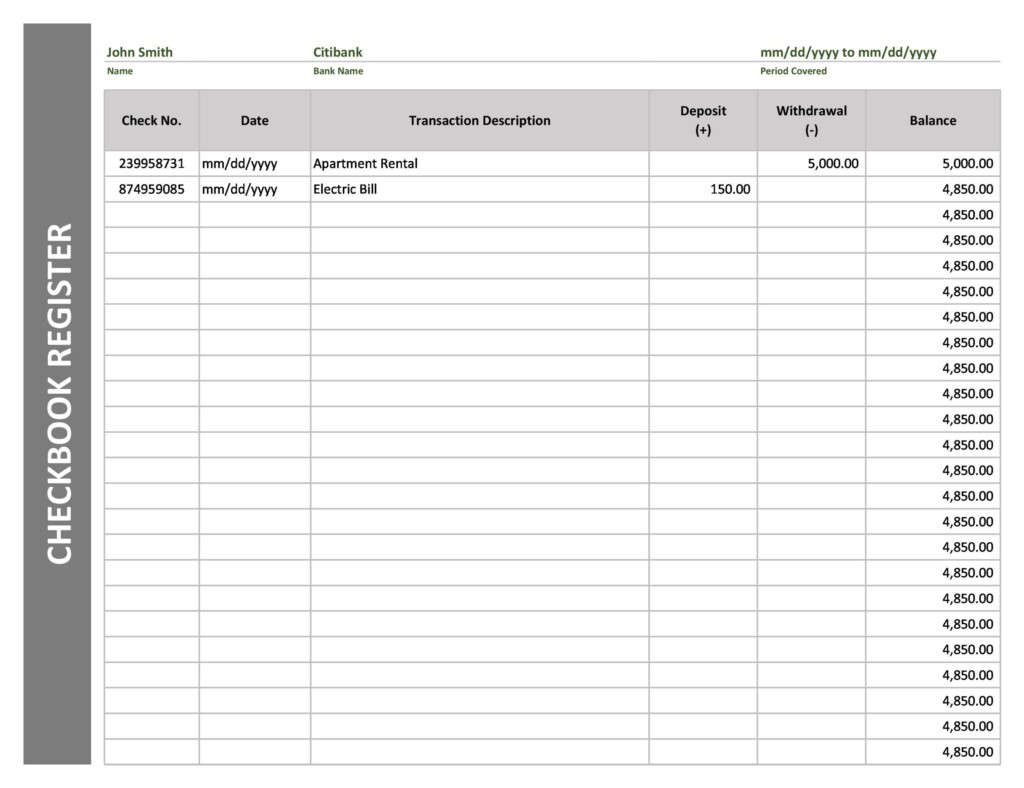

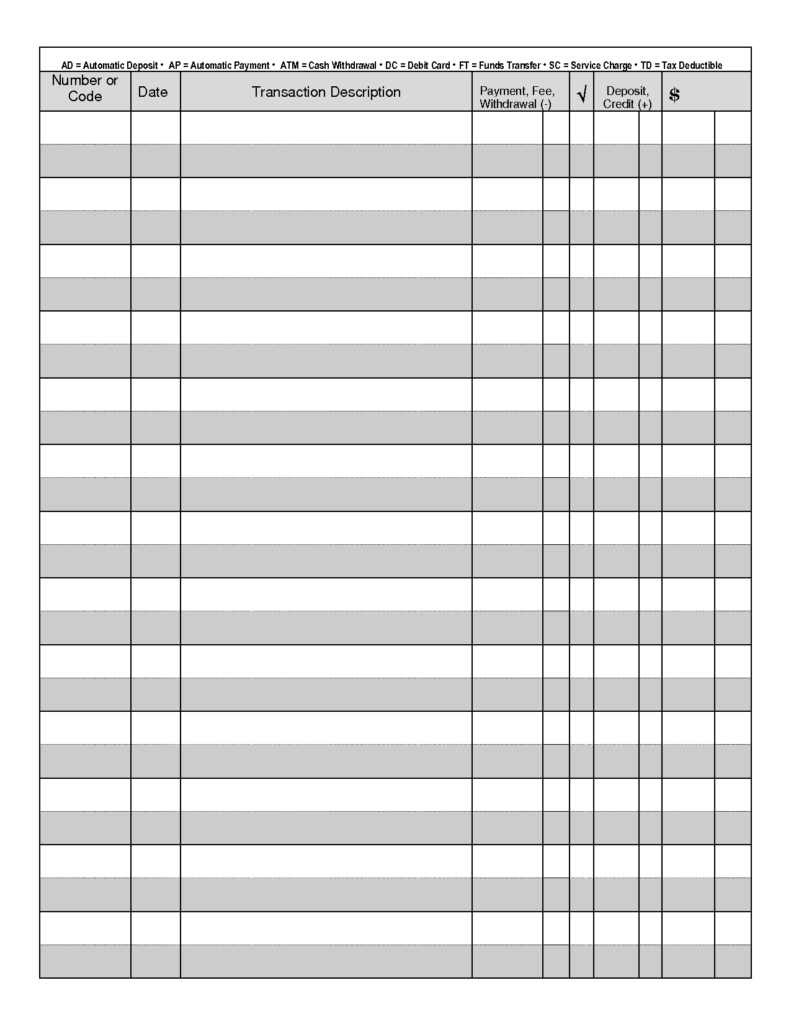

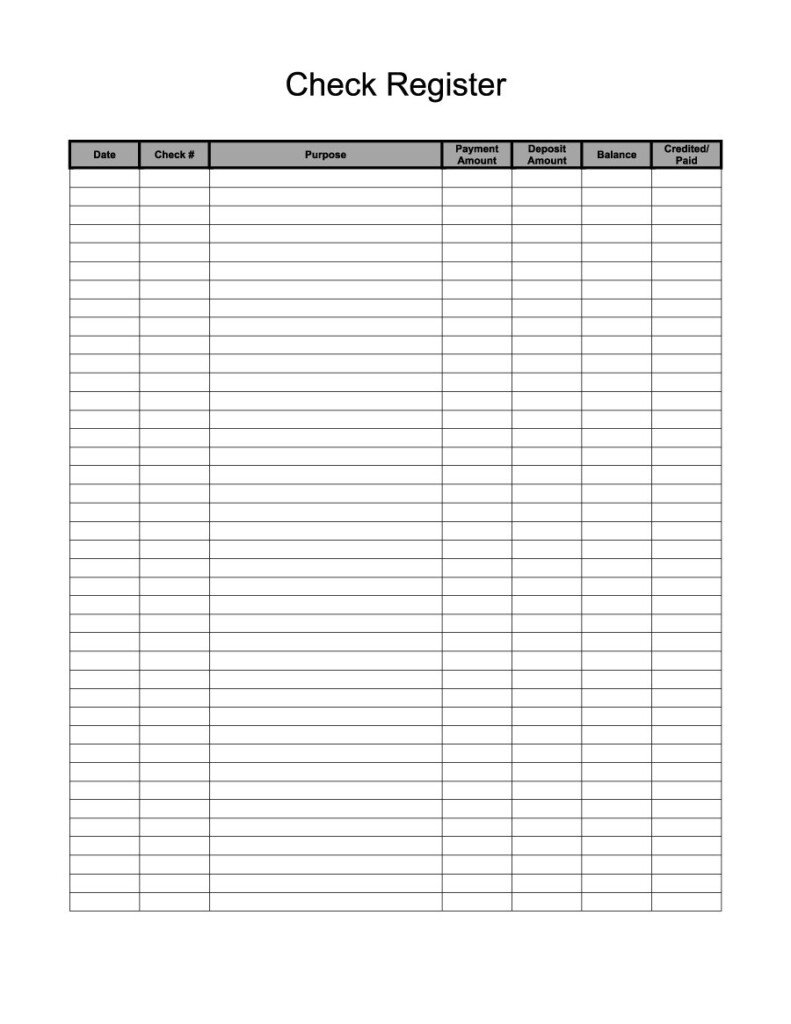

A checkbook register is a record-keeping tool used to track all transactions made through a checking account. It helps individuals keep track of their balance, monitor spending, and avoid overdrafts. While many people now rely on online banking and mobile apps to manage their finances, a checkbook register can still be a valuable tool for those who prefer a hands-on approach to tracking their expenses.

Keeping a checkbook register up-to-date requires recording each transaction, including deposits, withdrawals, and checks written. This allows individuals to reconcile their bank statements and ensure that they have an accurate picture of their finances at all times.

Why Use a Free Checkbook Register Printable?

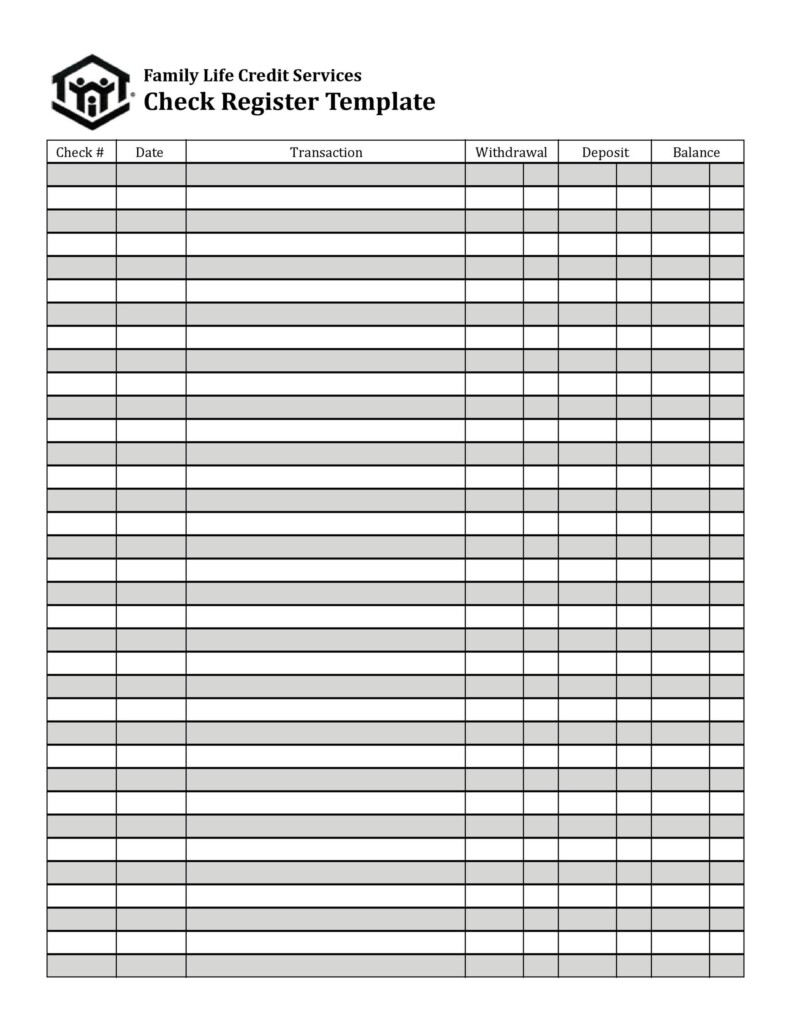

Using a free checkbook register printable can make it easier to keep track of your finances without the need for expensive software or apps. Printable checkbook registers typically come in a simple, easy-to-use format that allows you to record transactions quickly and efficiently.

By using a free checkbook register printable, you can take control of your finances and ensure that you are always aware of your current balance. This can help you avoid overdraft fees, identify any discrepancies in your account, and plan for future expenses more effectively.

How to Get a Free Checkbook Register Printable

There are many websites that offer free checkbook register printables that you can download and print for your personal use. Simply search for “free checkbook register printable” in your preferred search engine, and you will find a variety of options to choose from.

Once you have found a printable that meets your needs, simply download and print it out. You can then start using it to record your transactions and keep your finances in order. Regularly updating your checkbook register can help you stay on top of your spending and make informed financial decisions.

By using a free checkbook register printable, you can take control of your finances and ensure that you are always aware of your current balance. This can help you avoid overdraft fees, identify any discrepancies in your account, and plan for future expenses more effectively.