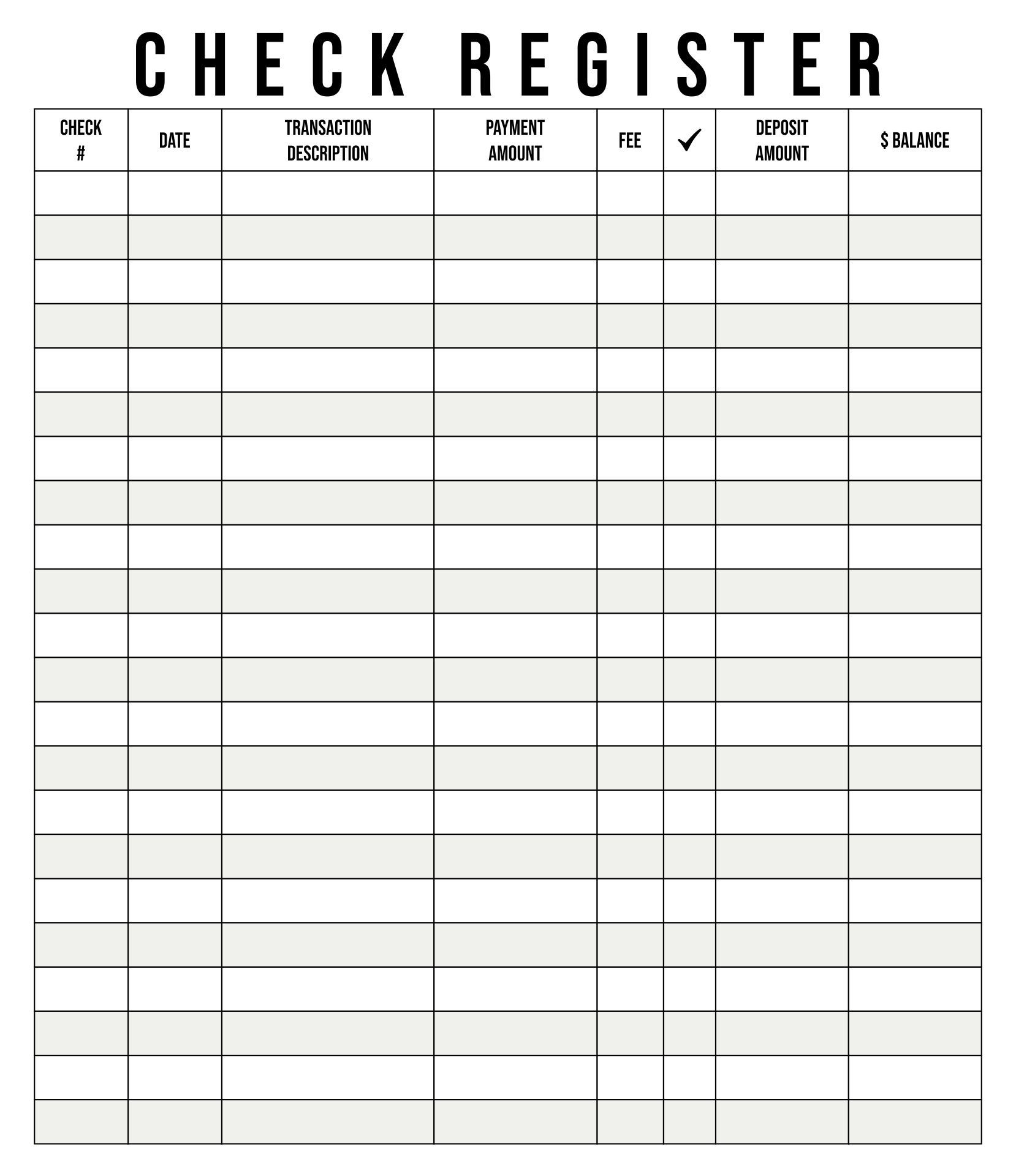

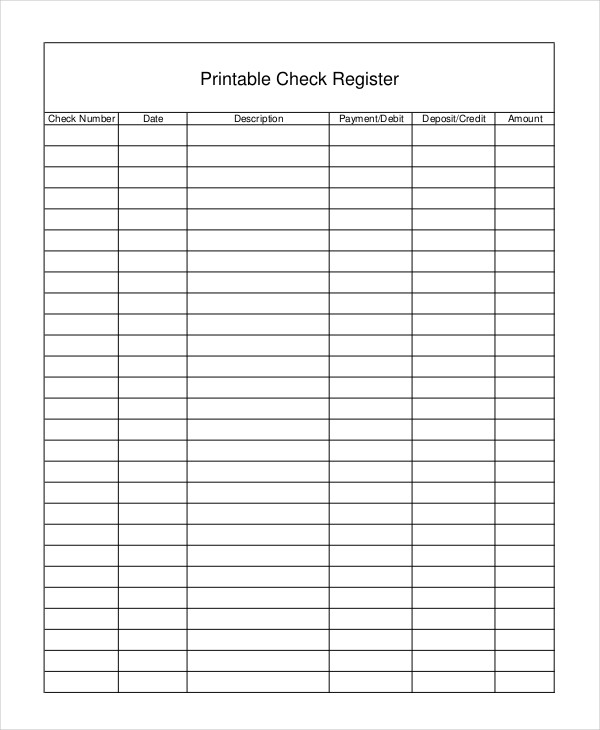

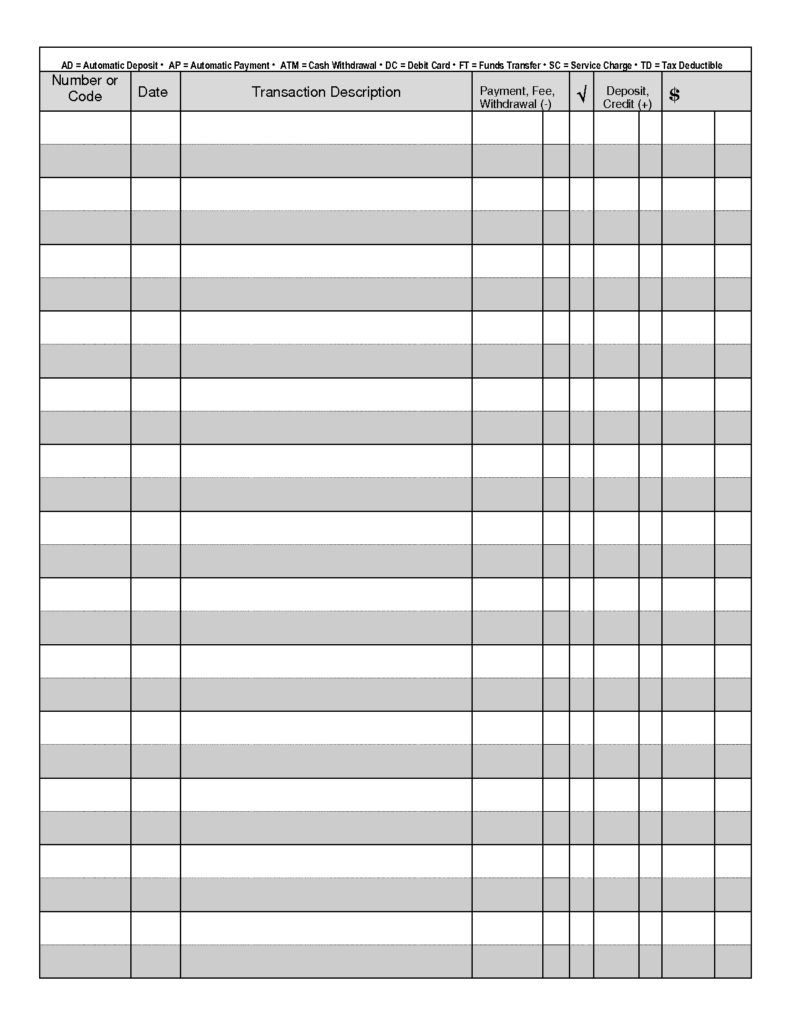

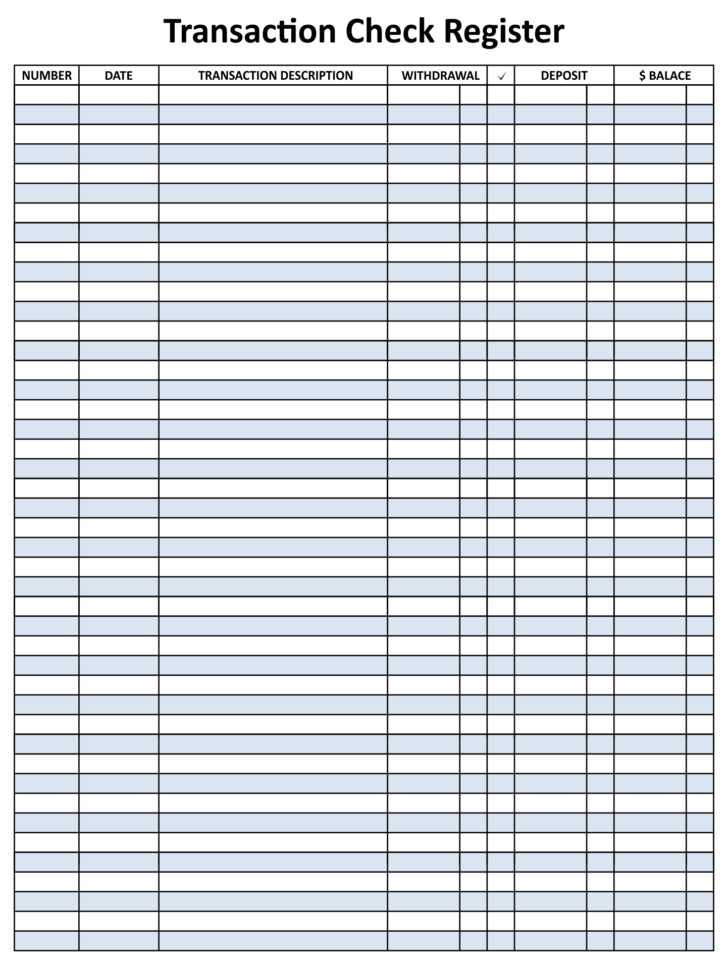

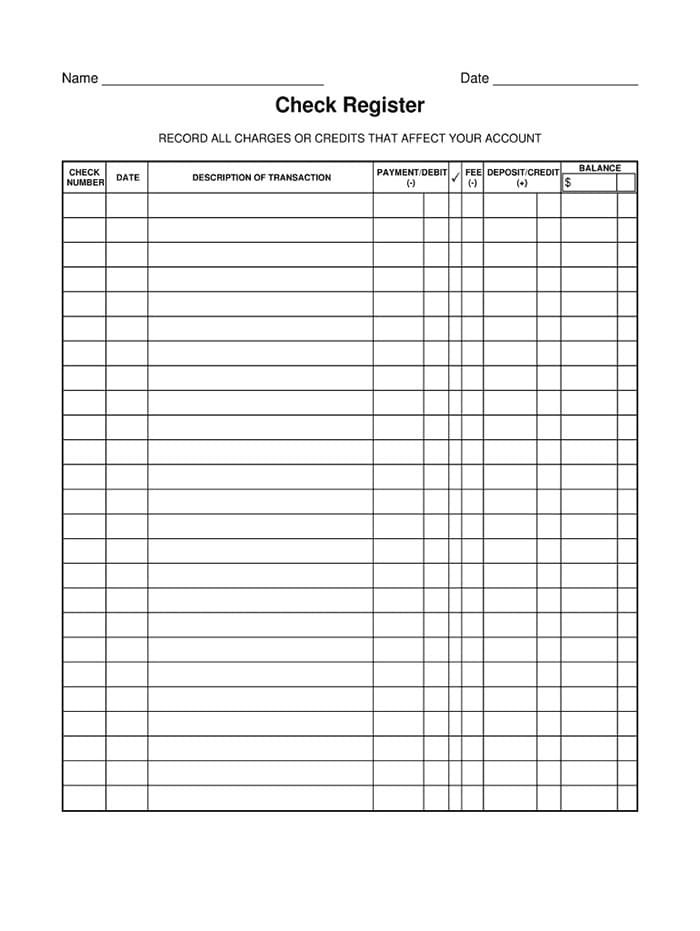

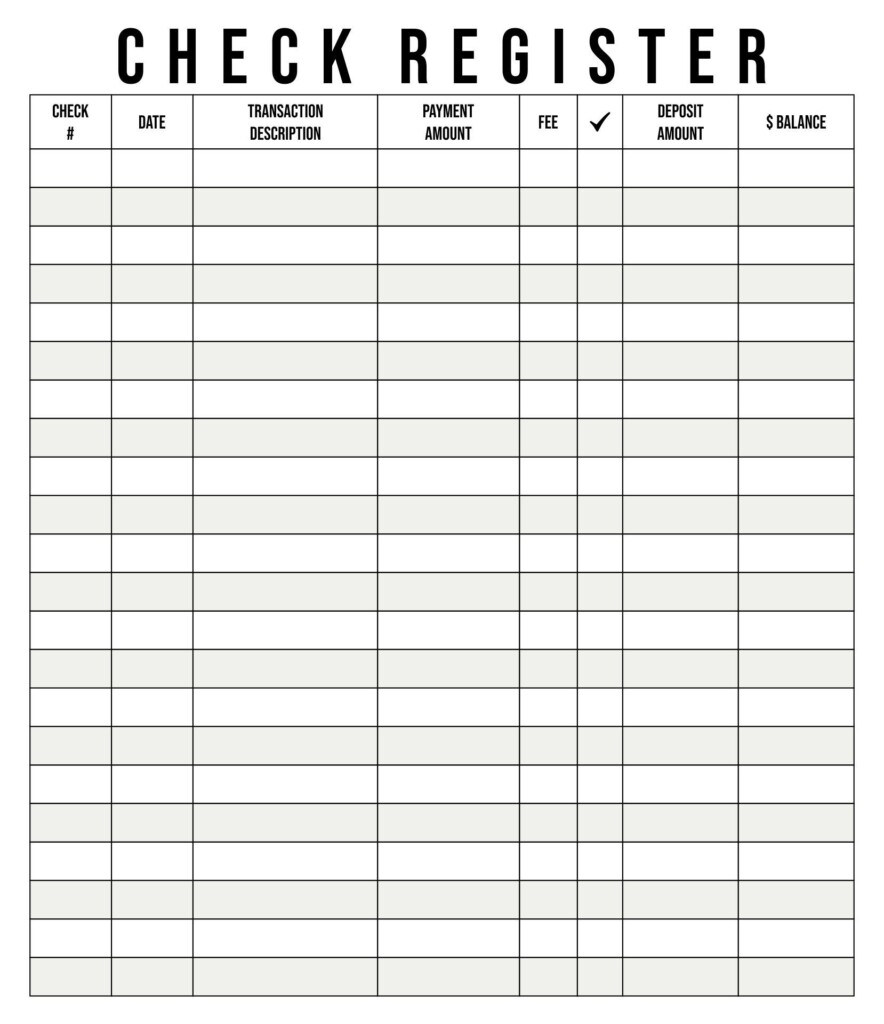

A printable check register is a simple tool used to keep track of your checking account transactions. It allows you to record deposits, withdrawals, and other transactions, helping you monitor your account balance and avoid overdrawing your account. By using a printable check register, you can easily reconcile your bank statement and ensure that all transactions are accurately reflected in your account.

There are several benefits to using a printable check register. Firstly, it helps you stay organized and keep track of your spending. By recording all your transactions in one place, you can easily see where your money is going and identify any areas where you may be overspending. Additionally, a check register can help you detect any unauthorized transactions or errors in your account, allowing you to take action quickly to rectify any issues. Finally, using a printable check register can help you budget more effectively and plan for future expenses, ensuring that you have enough funds to cover your financial obligations.

How to Get a Free Printable Check Register

If you’re looking for a free printable check register, you’re in luck! There are many websites that offer downloadable templates that you can print out and use at home. Simply search for “printable check register template” in your preferred search engine, and you’ll find a variety of options to choose from. Once you’ve selected a template, download and print it out, then start recording your transactions. It’s a simple and effective way to manage your finances and stay on top of your account balance.

In conclusion, using a printable check register is a great way to stay organized, monitor your spending, and ensure the accuracy of your account transactions. By utilizing a free printable check register, you can take control of your finances and make informed decisions about your money. So why wait? Start using a printable check register today and take the first step towards financial stability.